1. Purpose

The manager can recognize returned goods in multiple ways as below:

Create returned goods note

Create returned goods note from stock receipt note

Create returned goods note based on the previous returned goods note

2. Fields

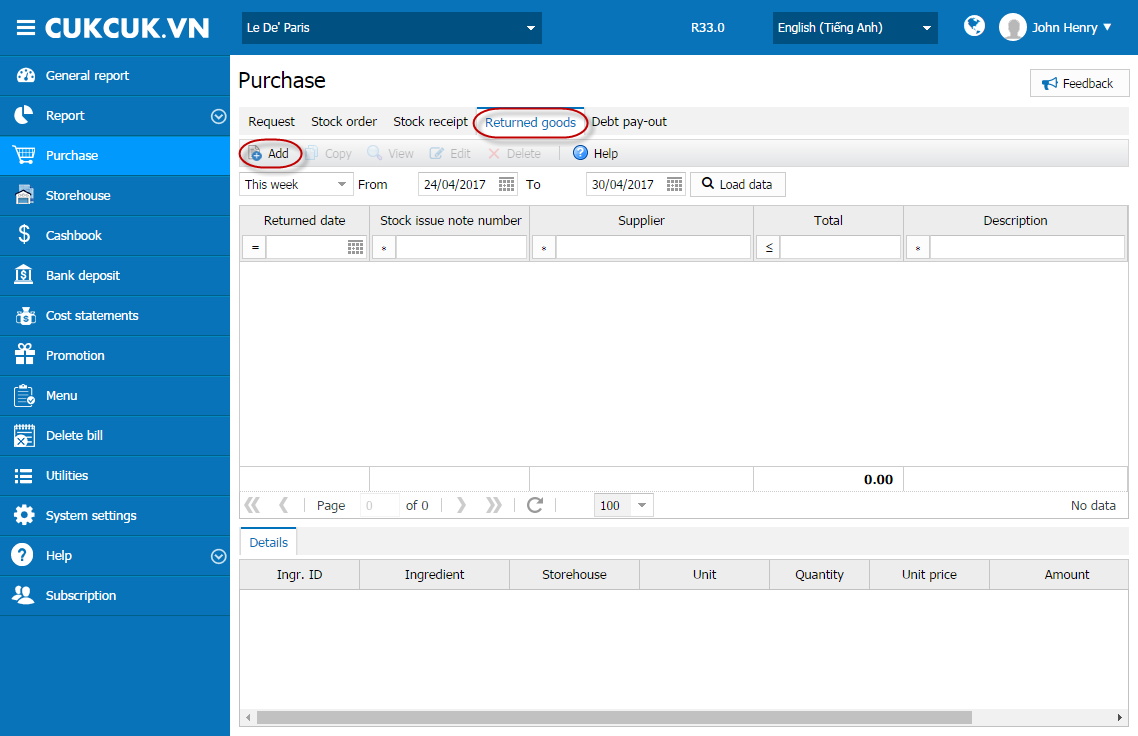

2.1. Create returned goods note

Instruction steps

To create a returned goods note, follow these steps:

1. Select Purchase\Returned goods.

2. Click Add.

3. Enter details of Returned goods note.

4. Click Save.

Note: You should enter Expiry date to track exact inventory quantity of ingredients with such expiry date in the storehouse.

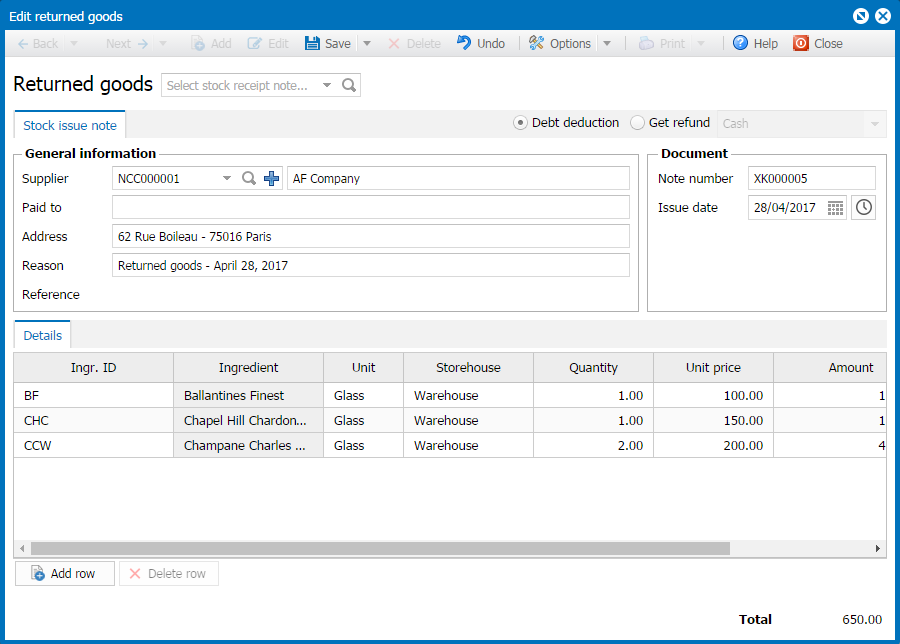

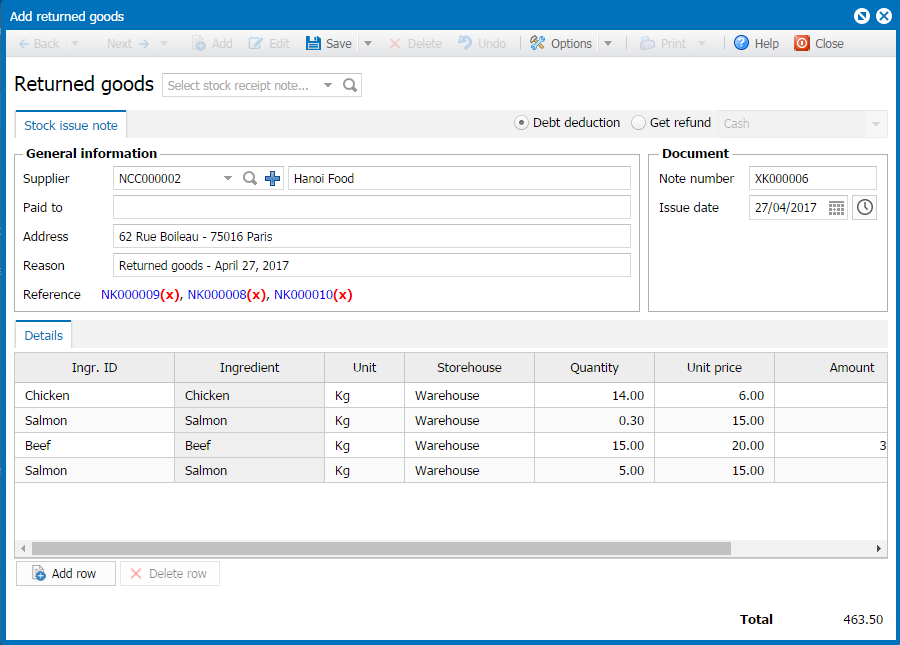

2.2. Create returned goods note from stock receipt note

Instruction steps

To create returned goods note from stock receipt note, follow these steps:

Alternative 1: Create returned goods note from stock receipt note by supplier.

1. Select Purchase\Returned goods.

2. Click Add.

3. Click this icon.

4. Enter information of Returned goods note: method of payment, reason, date, …

5. Click Save.

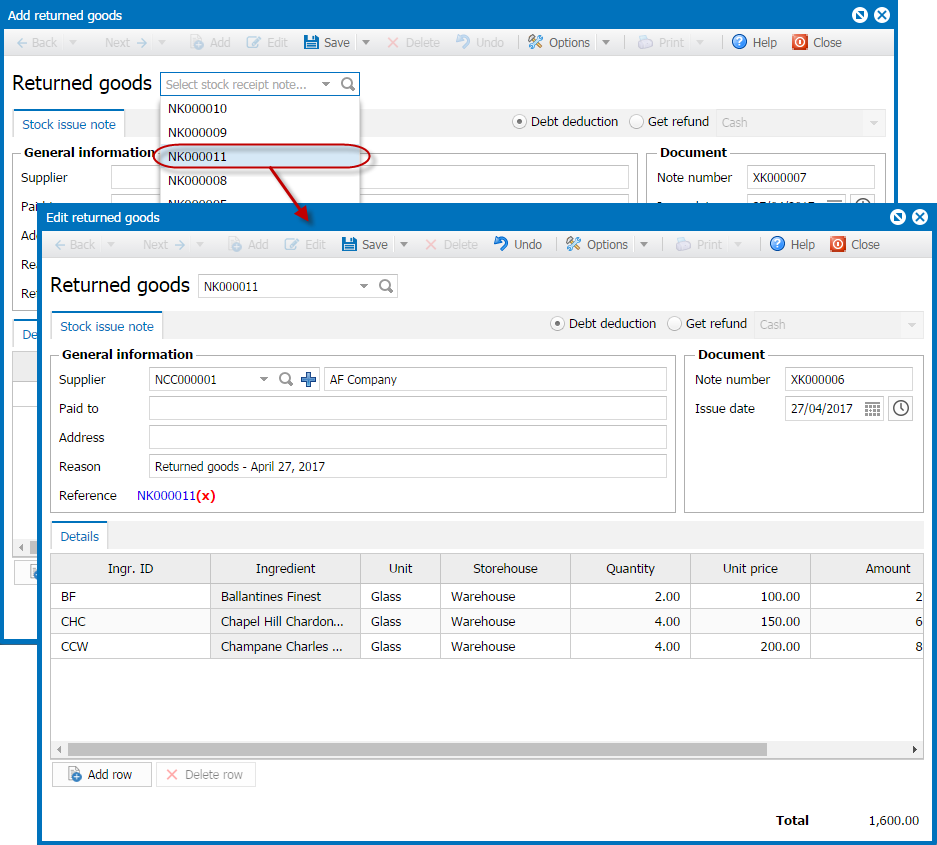

Alternative 2: Create returned goods note from stock receipt note.

1. Select Purchase\Returned goods.

2. Click Add.

3. Click this icon, Select Stock receipt note number.

4. Enter information of Returned goods note: method of payment, reason, date, …

5. Click Save.

Note: You should enter Expiry date to track exact inventory quantity of ingredients with such expiry date in the storehouse.

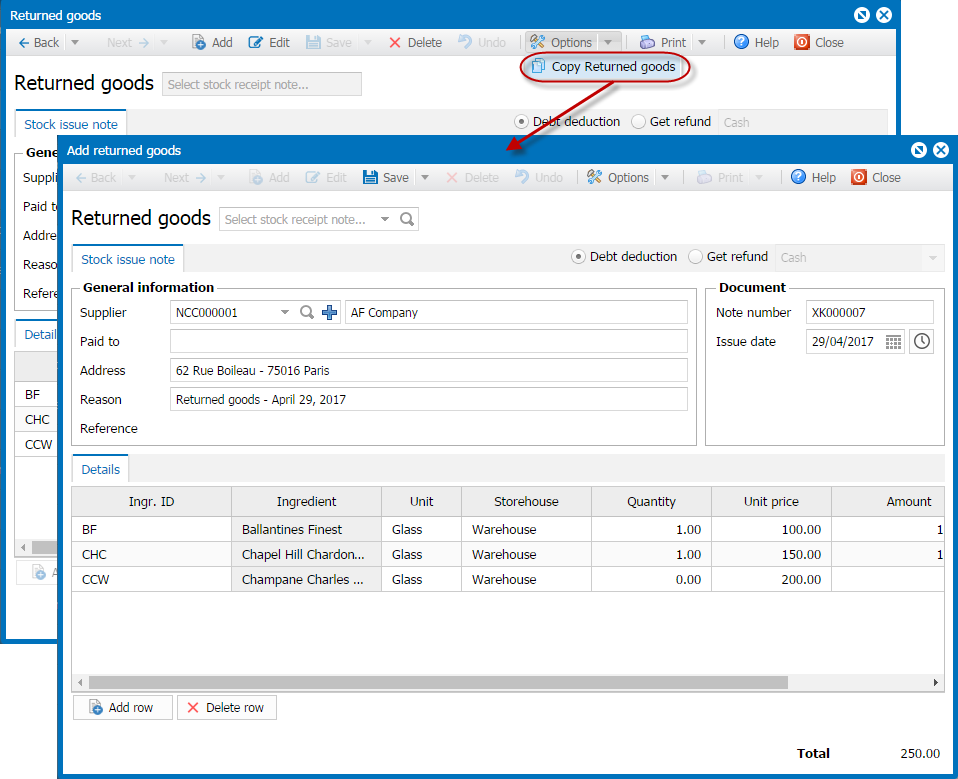

2.3. Create returned goods note based on the previous returned goods note

Instruction steps

To create a returned goods note from a previous returned goods note, follow these steps:

1. Select Purchase\Returned goods.

2. Select a returned goods note available on the list.

3. Click View.

4. Select Options\Copy returned goods.

5. Edit returned goods note properly such as reason, date,…

6. Click Save.

Note: You should enter Expiry date to track exact inventory quantity of ingredients with such expiry date in the storehouse.

3. Note

1. If you want to display Tax on Returned goods note, check “Display Discount and Tax on Stock Receipt Note, Stock Order, Stock Return Note” on System settings\General settings\Purchase/Sale tab\Sale.

2. If checking Deduct debt, total amount of the returned ingredients will be automatically updated to Track supplier debts.

3. If checking return by Cash/bank deposit, after saving the note information on bank transfer/pay-in note is managed at Cashbook/Bank deposit.