Closing balance of inventory is not correct because of one of these cases:

Case 1: The account changes the time to create stock issue note, so unit price of ingredients on the stock issue note is changed. To calculate unit price of ingredients on the stock issue note correctly and report exactly on General report on Stock Receipt – Issue – Inventory, follow these steps:

- Delete and enter all reports after the time of a stock issue note is changed.

For example: To change the time of creating a stock issue note from 5h30 on 16/09/2016 to 5h30 on 14/09/2016, delete it and enter a new note timed 5h30 on 14/09/2016.

Case 2: The accountant makes up a stock issue note, leading to wrong unit price of the ingredients entered after this make-up. To correct issue amount and closing inventory amount, follow these steps:

- Delete all stock issue notes after the make-up and enter new ones.

For example: Adding stock issue note at 9h30 on 15/09/2016 changes unit price of the ingredients on the stock issue notes made after 9h30 on 15/09/2016. The account needs to delete all of the wrong notes and enter new ones.

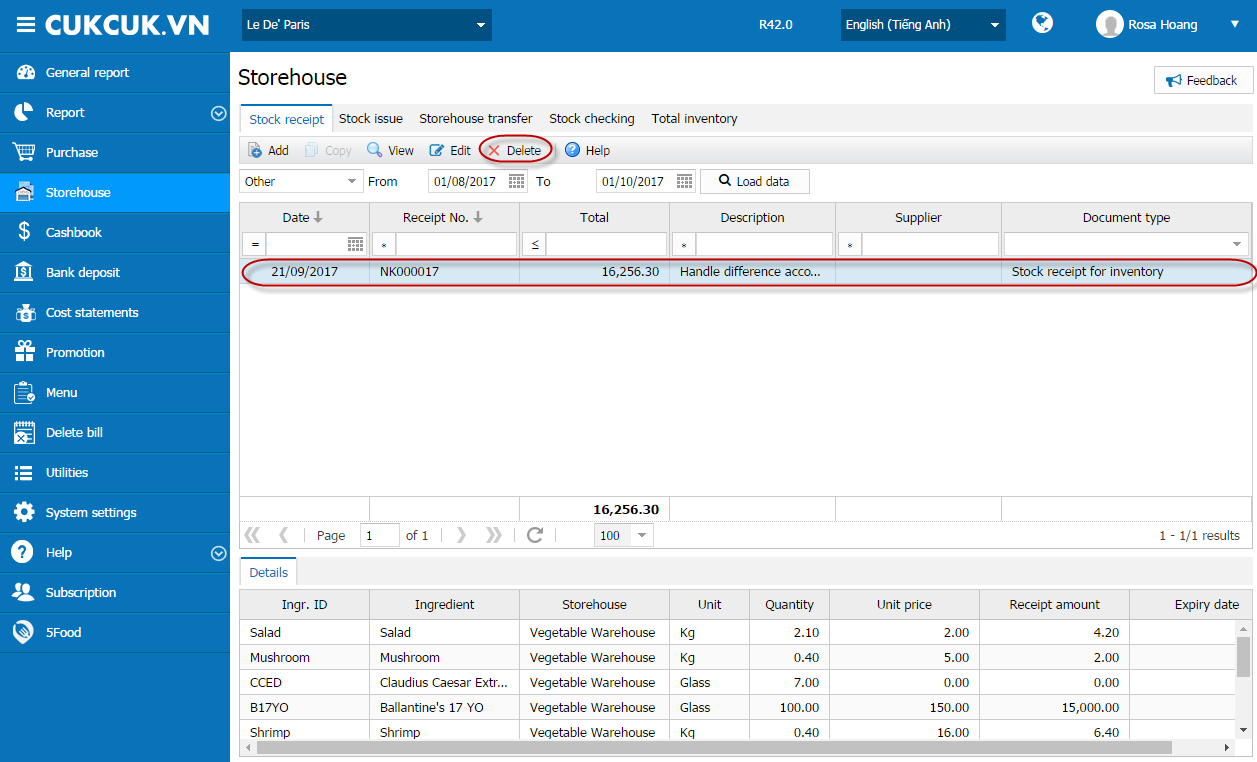

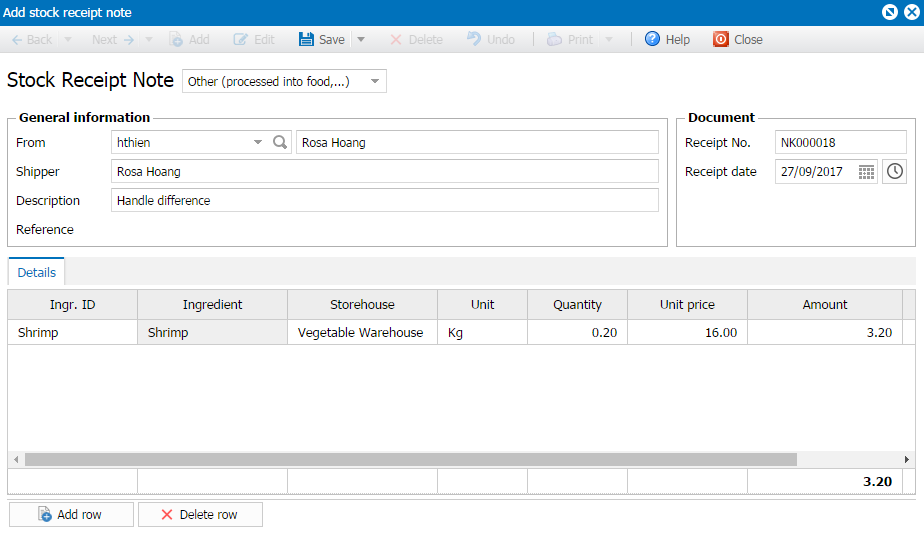

Case 3: The accountant has not created a stock receipt note on software but a stock issue note, which exceeds the inventory quantity and cannot calculate unit price of stock issue and inventory quantity of ingredients. To solve this problem, follow these steps:

- Delete the stock issue note which issues more ingredients than the inventory quantity.

- Make up a stock receipt note.

- Create a stock issue note again. Then, the software can calculate correctly unit price of stock issue and inventory quantity of ingredients.