Purpose: Previously, the program only had the field Restaurant information and defaulted loading it as Company information. However, for a restaurant chain with many branches, the information of the first branch entered upon registration can be different from the company information. This results in wrong information in DSFinV-K export template. As of R112, the program adds the field Company information so that the restaurant can update it accurately.

Details of change:

1. Restaurant chain

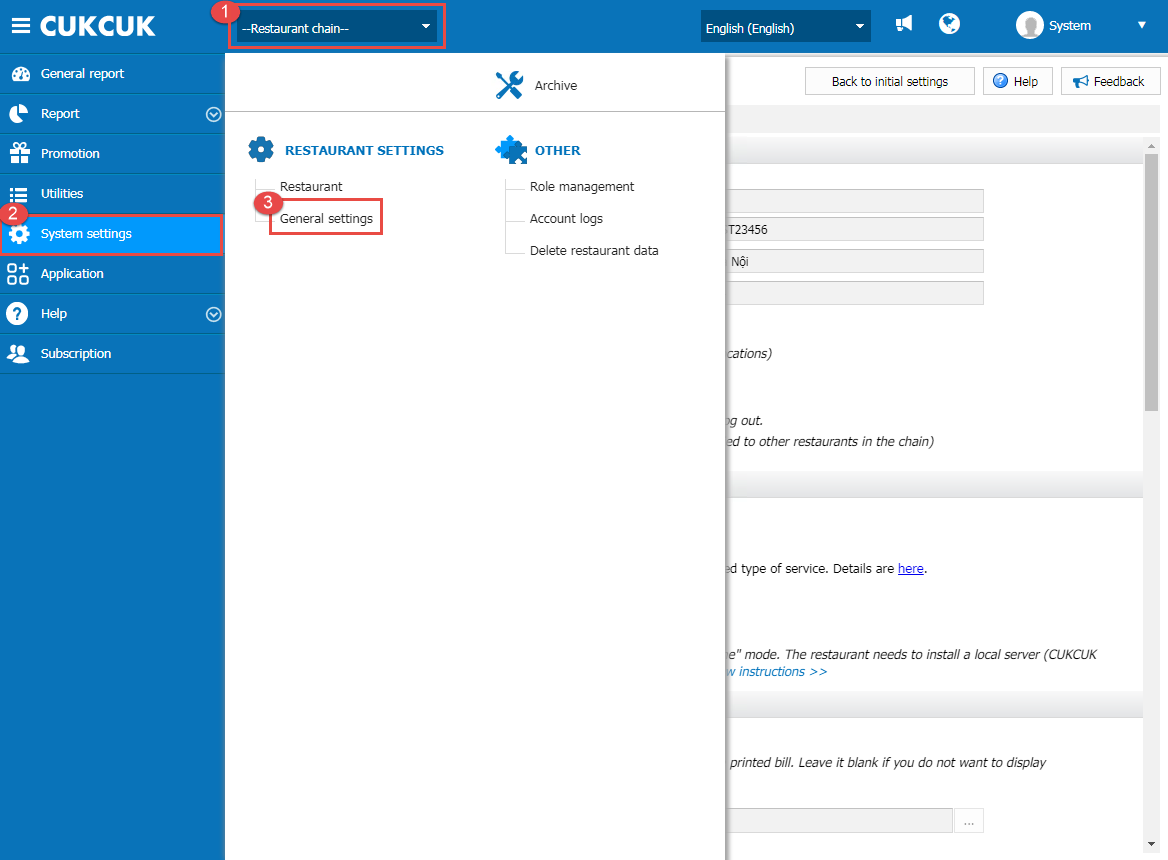

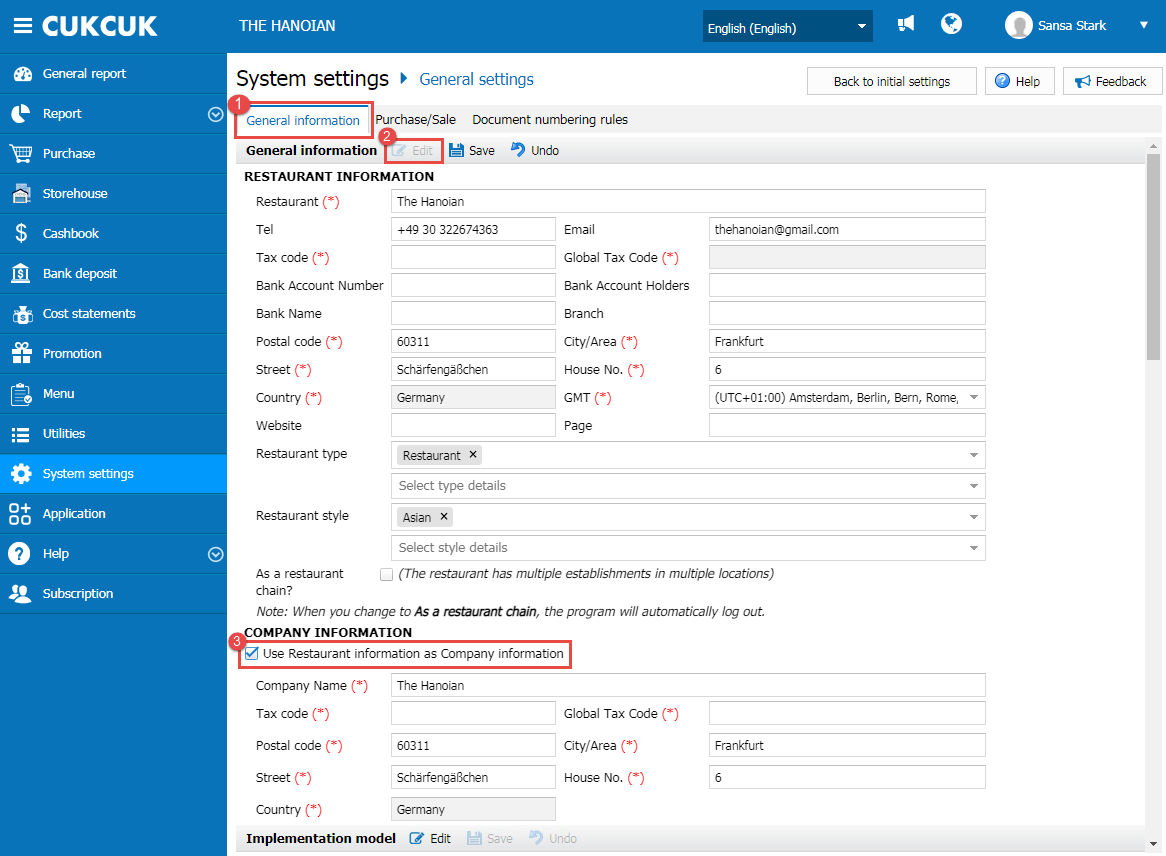

On the management page, select Restaurant chain. Then, go to System settings/General settings.

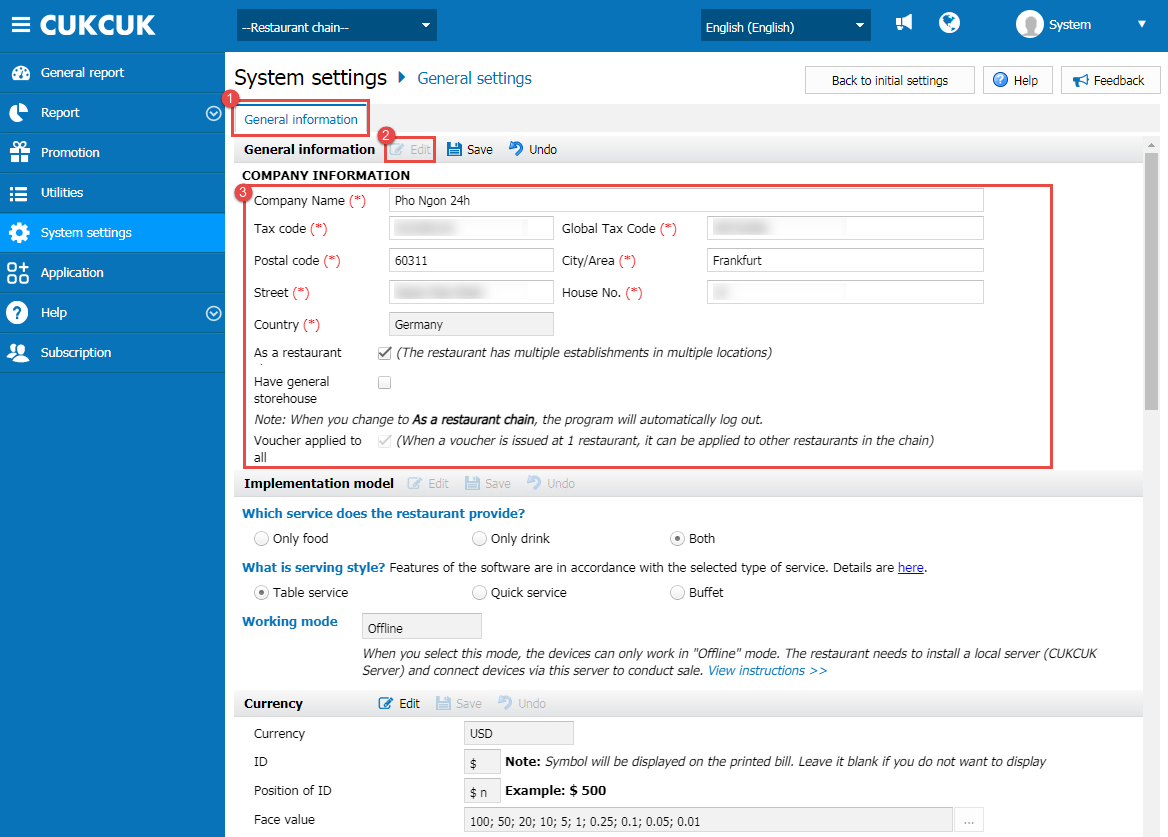

On General information tab, click Edit. Then update your company information according to the business license.

2. Single restaurant

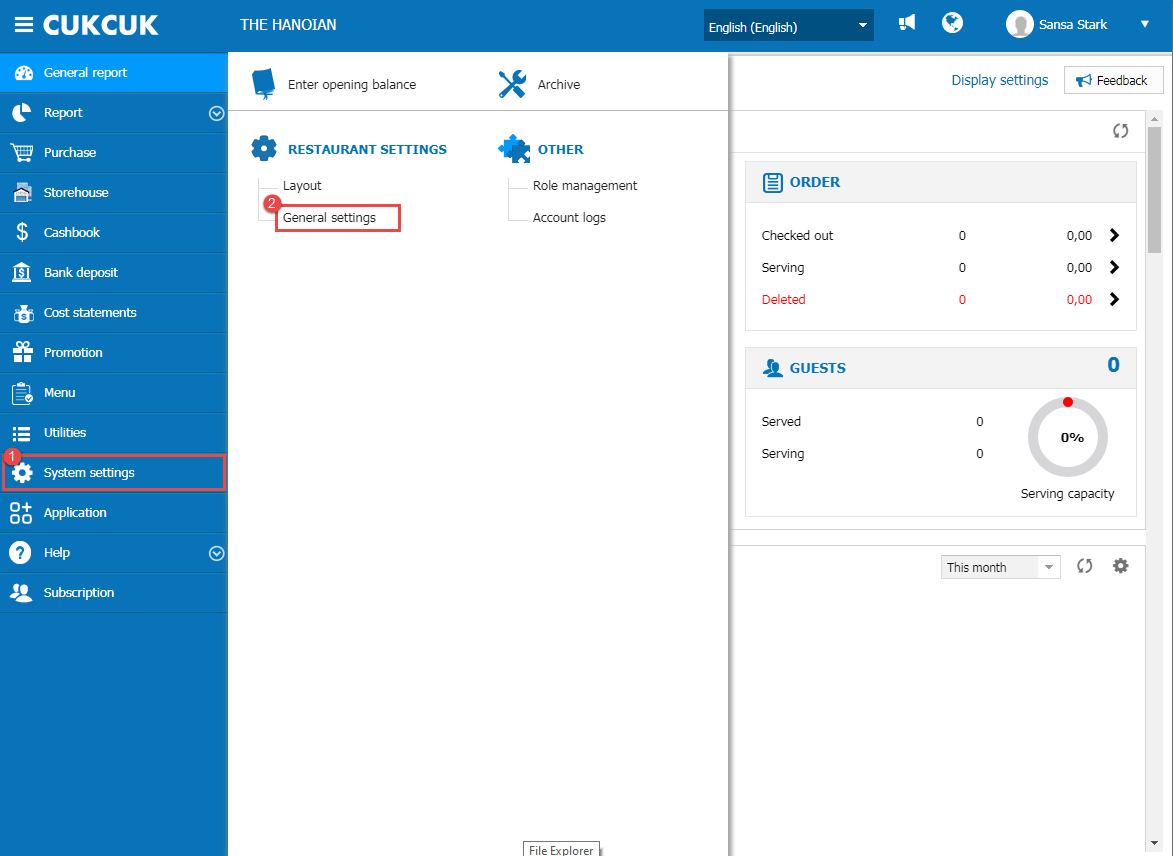

The same as restaurant chain. Go to the management page and select System settings/General settings.

On General information tab, click Edit. Update information according to the business license. If the restaurant information is the same as the company information in the business license, check Use Restaurant information as Company information.

Purpose: Previously, the program did not allow to save multiple tax types with the same tax rate. As of R112, this feature is added.

Details of change:

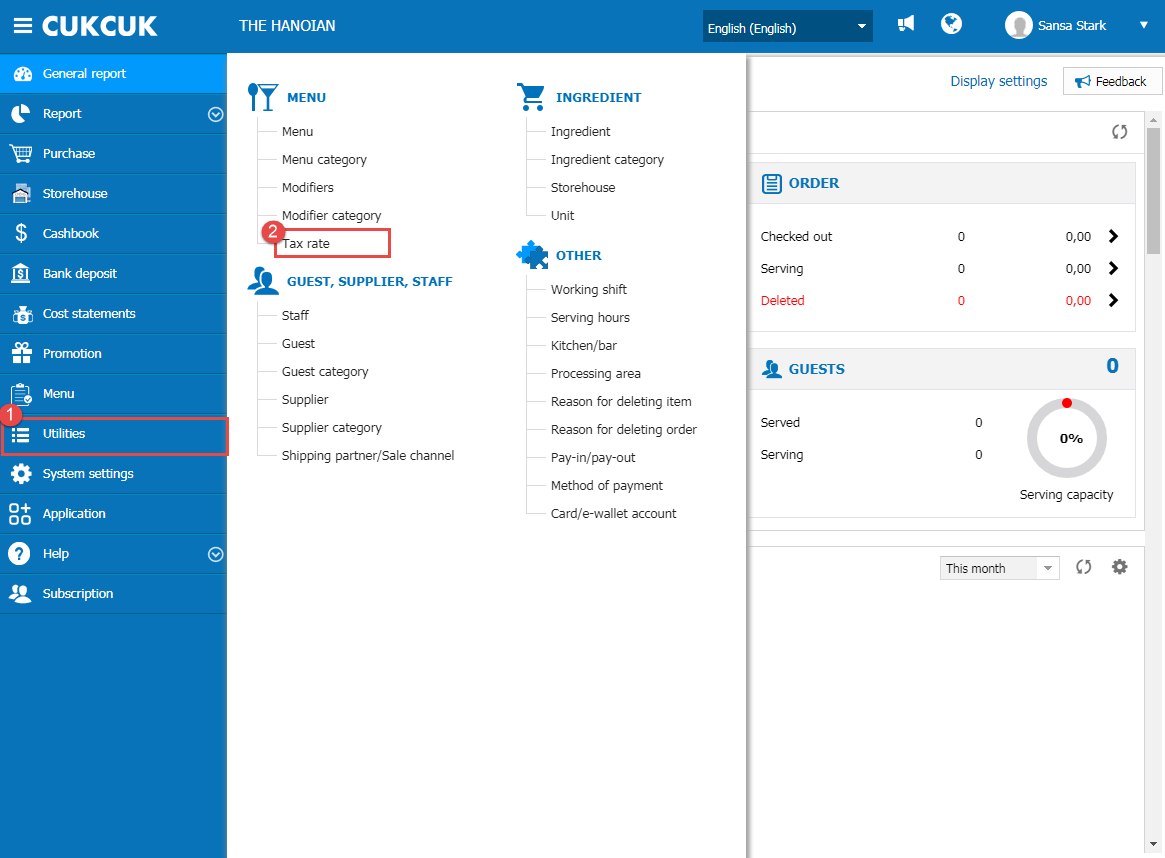

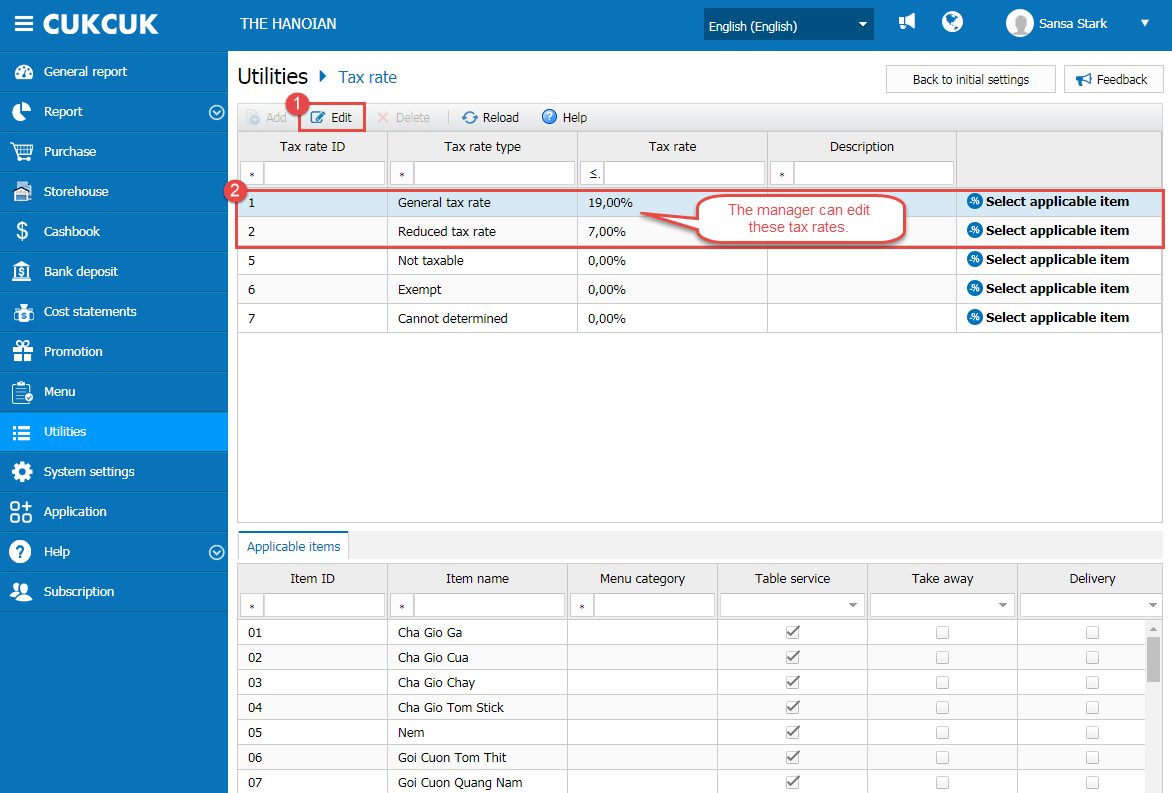

On the management page, go to System settings and select Tax rate.

Here the program defaults 5 tax rate types: General tax rate, Reduced tax rate and 3 different tax types with the same tax rate: Not taxable, Exempt, Cannot be determined. Among these tax rate types, the manager can edit General tax rate and Reduced tax rate.

Purpose: Previously, the program did not specify types of payment method, which might lead to wrong information in DSFinV-K export template. As of R112, the program adds Type column in Utilities/Method of payment.

Details of change:

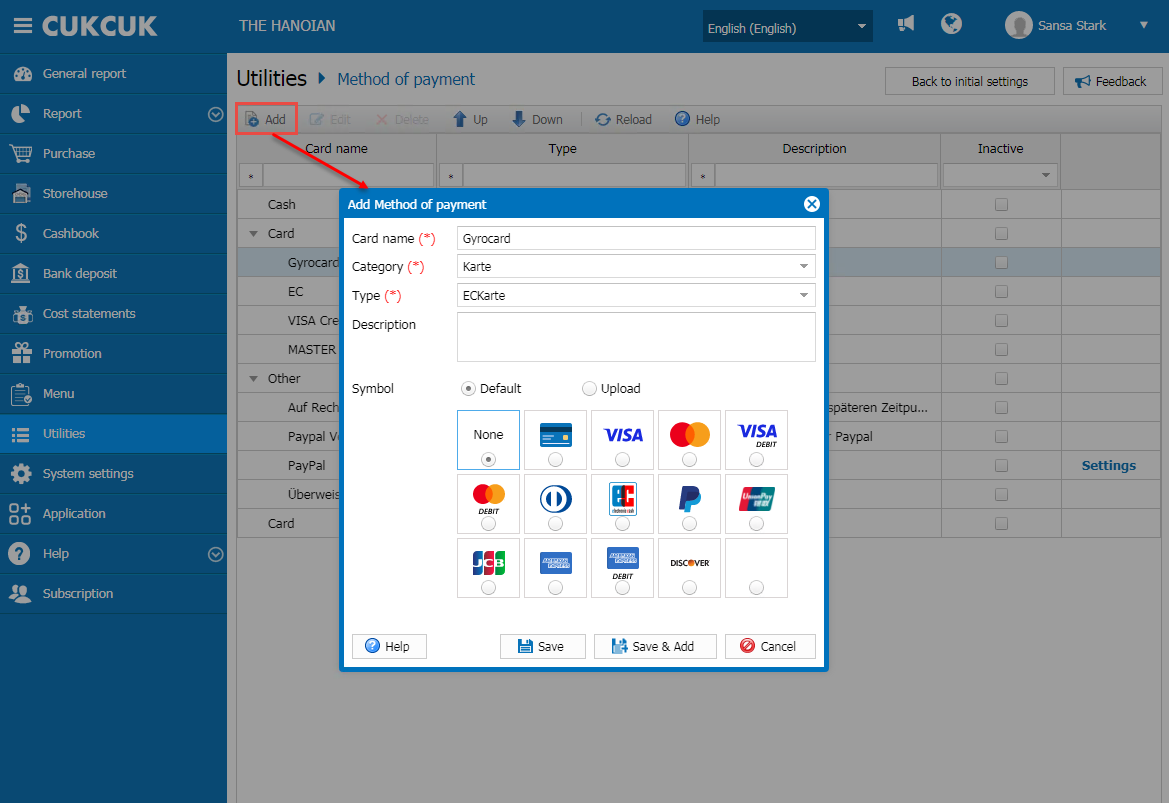

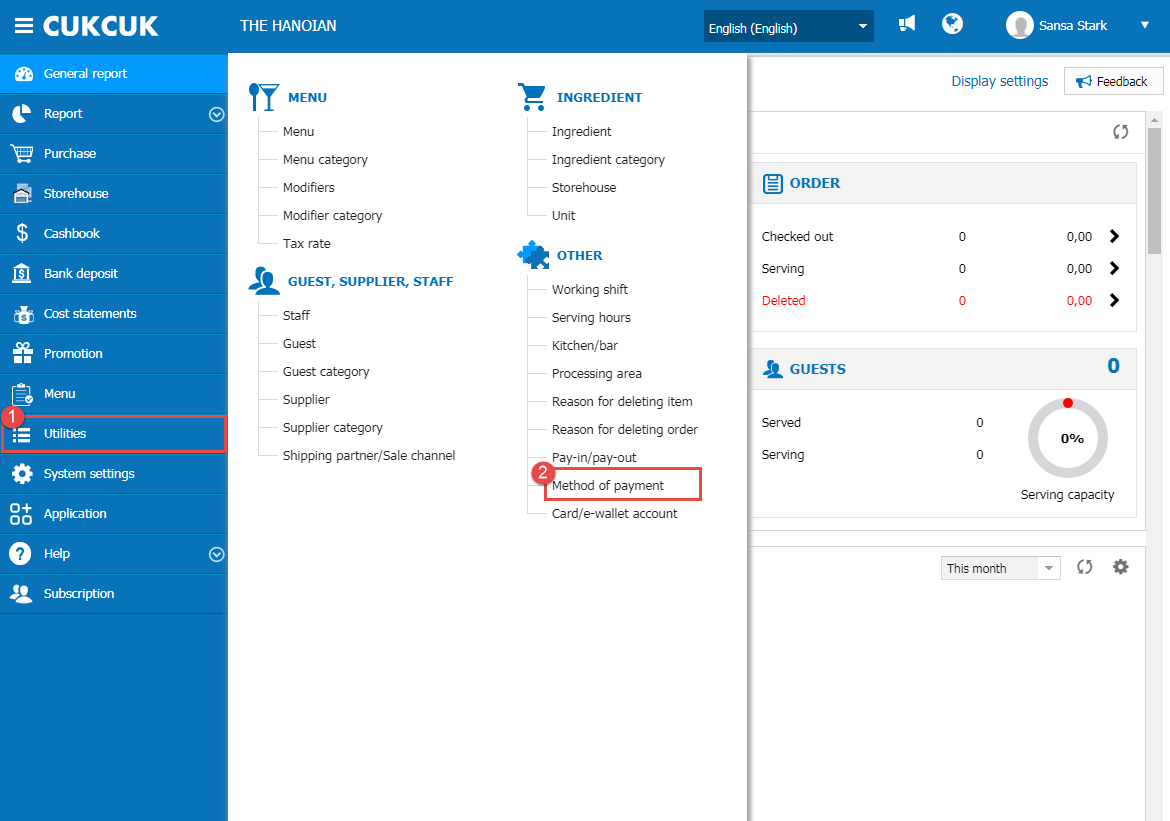

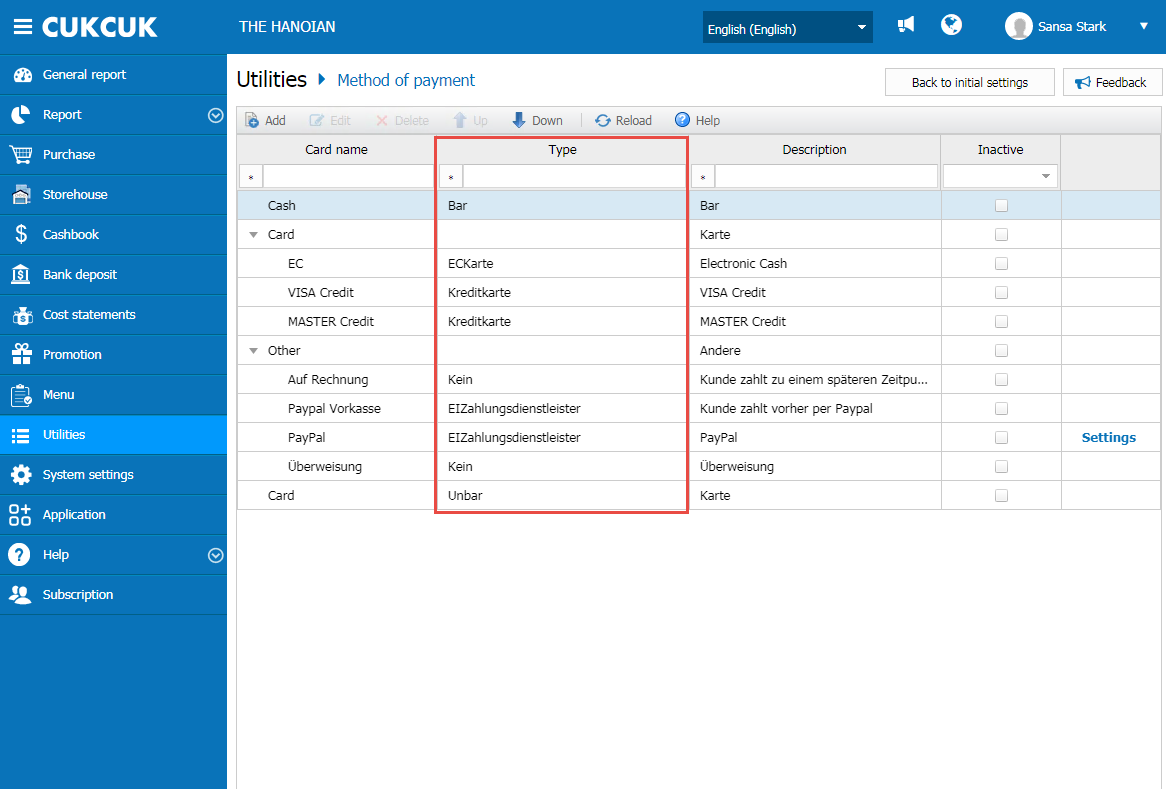

On the management page, select Utilities/Method of payment.

The program defaults the following types of payment method:

- Bar – Cash: Transactions are paid by cash.

- Keine – Unidentified: Transactions are made but no payments are made.

- ECKarte – Debit card: Transactions use debit cards.

- Kreditkarte – Credit card: Transactions use credit cards.

- EIZahlungsdienstleister – Electronic payment units: Transactions via electronic devices that are not recorded as ECKarte, Kreditkarte or Guthabenkarte.

- Guthabenkarte – Pre-paid cards: Transactions use prepaid cards. Prepaid cards are considered as a method of payment, which can be refunded for unused amount in any case, at any time.

The manager also can add other method of payment by clicking on Add. Then enter card name, category, type, and select an available symbol or upload it.